JSS Payouts 2021: 3 Important Things to Know

With the latest restrictions taking a hit on business once more given the period of heightened alert, businesses are on the lookout for governmental support such as the Job Support Scheme (JSS) once again. The JSS aims to help employers subsidise employees’ wages in order to protect their jobs. Here are three things you need to know about the upcoming JSS payouts in September 2021.

#1 JSS Payouts

For the June 2021 Payout, most businesses that are eligible for the JSS Scheme should look out for their payouts after 30 June 2021. Organisations who have an existing GIRO arrangement or are registered PayNow Corporate accounts were stipulated to receive their JSS payouts starting from 30 June 2021. Otherwise, other organisations should have received their cheques from 5 July 2021 at their registered business address. Do note that the Inland Revenue Authority of Singapore (IRAS) has not completed the disbursement of the July 2021 JSS payouts yet. As such, if your company has yet to receive the payout, rest assured that this is no cause for concern.

JSS Scheme Payout Schedule

JSS Support

JSS Support

April to July wages

Sep 2021

August wages

Dec 2021

#2 The Latest JSS Payouts: Enhanced Support Measures

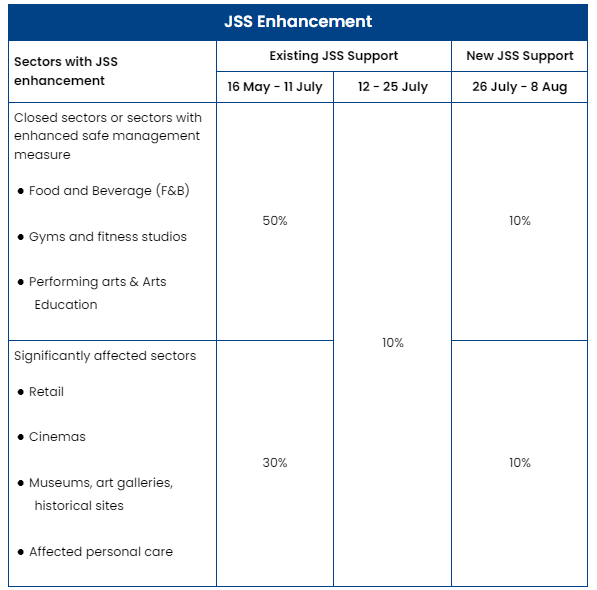

In light of the business slowdown during the recent Heightened Alert phase, JSS’ enhancements have been extended by three weeks, from 21 June 2021 – 11 July 2021, for closed sectors or sectors with enhanced safety safe management measures. This also applies to significantly affected sectors including businesses in retail, cinemas, museums, art galleries, historical sites, family entertainment and affected personal care. Additionally, the above-mentioned sectors will continue to receive 10% of support over 2 weeks between 12 to 25 July 2021. Eligible organisations in these sectors can expect to receive the enhanced payouts in September 2021.

#3 How Much Will You Be Receiving?

There are several factors that determine the amount you receive in a JSS payout: which payout you are looking at, the tier your company falls under, and your company’s past wages. The first factor, the payout you are looking at, is relatively straightforward as each payout differs due to the support given by the government. With regards to the second factor, according to the Inland Revenue Authority of Singapore (IRAS), the “base tier of support employers receive depends on the sector in which the employer operates”. Find out which tier your company falls under in this scheme. Finally, payouts are derived from past wages. In other words, any changes made to your wages such as pay cuts during this period will affect the total amount you will be receiving from the scheme. To further assist you, you can calculate the amount you will be receiving with the JSS Calculator.

Leverage on JSS to help your business adapt

The pandemic has indubitably had negative impacts on most businesses. We take heart that there are existing government support schemes to help us tide through this difficult period. In the meantime, let’s ride the wave of change capitalise on this opportunity to adapt our businesses to the new norm!

You can also read our article on how the Jobs Growth Incentive can help your organisation. If you are keen to find out more about how you can save cost, check out our articles on Payroll Outsourcing Vs Employee Outsourcing – Secrets to Business Optimisation and Human Resource Management Insights That You Need To Know.

Reference:

- Job Support Scheme, from Inland Revenue Authority of Singapore

- Specific Industries in Tiers and SSIC Codes, updates on the enhancements to JSS for Affected Sectors from 16 May to 8 Aug 2021, from Inland Revenue Authority of Singapore